Executive Summary:

Recent articles in the Wall Street Journal and other media outlets including investment blogs and message boards have referenced a little-known strategy for adding to Roth savings within a 401(k) Plan. This strategy, referred to as “Mega Backdoor” Roth funding, is technically sound but very difficult to put into practice for most 401(k) Plans.

401(k) Plan Sponsors should review IRS discrimination testing rules specific to their Plans and carefully evaluate plan demographics, plan participation and average deferral data before amending their plans to facilitate the “Mega Backdoor” Roth strategy.

Why? The IRS annual discrimination testing (specifically the Actual Contribution Percentage or ACP) Test applies to voluntary after-tax plan deferrals which potentially reduce or eliminate “Mega Backdoor” conversion opportunities completely.

Additional administrative complexities associated with In-Plan Roth conversions should be reviewed with your plan’s recordkeeping partner, along with Participant communication efforts before amending your 401(k) plan to allow for this conversion strategy.

Aegis Retirement Partners is a third-party administration and consulting firm specializing in the qualified retirement plan marketplace. When it comes to Plans sponsored by small to mid-size plan sponsors (under 1000 Participants), we have identified few viable scenarios that allow for Mega Backdoor” Roth strategy work successfully.

This white paper delivers in depth background on “Mega Backdoor” concept starting with some basics on Roth conversions, 401(k) plan savings limits, In-Plan Roth conversions, and discrimination testing challenges associated with after-tax contributions. Have questions about this for your plan? Call us we’d be happy to help.

Aegis Retirement Partners, LLC

86 Baker Ave Extension, Suite 309

Concord MA 01742

(781) 604-9007

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Aegis Retirement Partners and Cambridge are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (781) 604-9013. This email service may not be monitored every day, or after normal business hours. These are the opinions of Doug Norberg and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized advice. Please be sure to speak to your financial professional to carefully consider the differences between your company retirement account and investment in an IRA. These factors include, but are not limited to changes to availability of funds, withdrawals, fund expenses, and fees. Please speak to your tax professional regarding your unique circumstances. Cambridge does not offer tax advice. These examples are hypothetical and for illustrative purposes only. The rates of return do not represent any actual investment and cannot be guaranteed. Any investment involves potential loss of principal.

Overview:

The term “backdoor” Roth was coined to describe a strategy to fund a Roth IRA by individuals who would otherwise be precluded from doing so based on their modified adjusted gross income (MAGI). To contribute to a Roth IRA in 2021, single tax filers must have MAGI of $140,000 or less. If married and filing jointly, total MAGI must be less than $208,000. Individuals or married couples filing jointly with MAGI exceeding these levels are precluded from contributing to Roth IRAs in 2021.

Retirement savers who are precluded from contributing to a Roth IRA may still fund a Roth using a conversion method, i.e., the “backdoor” strategy which is permissible regardless of MAGI levels. The “backdoor” Roth funding method is perfectly legal although individuals who are considering this strategy are strongly advised to consult with their investment and tax planning professionals before initiating.

Many sources may be used to fund a Roth using the “backdoor” method (traditional IRA, non-deductible IRA, rollover IRA). This is not a tax dodge, amounts converted from any previously “untaxed” IRA to Roth will be taxed as ordinary income in the year of the conversion. Here are two very simple examples of the “backdoor” conversion process.

Example 1: Mary does not qualify to contribute to her Roth IRA in 2021 because her MAGI is over $140,000 as a single tax filer. Mary contributes to a traditional IRA (up to $6,000), and subsequently converts this to Roth using the “backdoor” method. The entire amount of the contribution plus any earnings will be taxed as ordinary income in the year of the conversion. Note, if the contribution to the traditional IRA is “non-deductible”, only investment gains in the account will be taxed as ordinary income.

Example 2: George is married and he and his spouse file jointly. George does not qualify to contribute to his Roth IRA in 2021 because he and his spouse have MAGI is over $208,000 “married filing jointly”. George has an existing IRA consisting of previously untaxed contributions and investment gains. George converts the entire IRA to Roth using the “backdoor” method. The entire amount of the conversion will be taxed as ordinary income in the year of the conversion. George elects to convert only a portion of his pre-tax IRA to Roth using the “backdoor” method and only the amount converted will be subject to ordinary income taxes.

Both examples are very basic but accurately outline the “backdoor” method of funding a Roth IRA.

Another Roth conversion option may be available to individuals who participate in 401(k) Plans that include a Roth 401(k) deferral option and allow for In-Plan Roth conversions. If applicable, Participants may convert pre-tax 401(k) monies to Roth 401(k) within their 401(k) Plan. Amounts converted from pre-tax to Roth within the 401(k) Plan are subject to ordinary income taxes but not excise tax penalties. Additional 401(k) savings may not be withdrawn to pay taxes unless the participant is otherwise eligible for the in-service withdrawal.

Example 3: Mary participates in a 401(k) Plan and has a pre-tax balance of $100,000 dollars. In 2021, Mary elects to “convert” $20,000 of her overall balance from pre-tax to Roth. Once the conversion is completed, Mary’s balance will still be $100,000 but it will consist of $80,000 of pre-tax and $20,000 of Roth assets. Mary will pay ordinary income taxes on the $20,000 conversion in 2021.

There are no IRS limits on the amount of pre-tax monies that may be converted in the 401(k) Plan but Plan specific limits may apply. Participants considering this conversion strategy are strongly advised to consult with their tax planning professional to pre plan for year-end tax implications.

The “Mega Backdoor” strategy conversion works the same way as the “backdoor”, but it involves a different funding source, namely voluntary “after-tax” contributions made to a 401(k) Plan. The term “after-tax” contributions inside a 401(k) Plan is not a reference to Roth 401(k) which is a common misconception. In this case, after-tax deferrals refer to a unique Participant contribution source. After-tax deferrals are subject to different tax treatment and additional discrimination testing issues that will be outlined below. The term “Mega” is used because permitted after-tax contribution levels in the 401(k) may be significantly higher than annual contributions to an IRA, creating a larger “Mega” opportunity to fund the Roth401(k). Since monies used to fund the Roth involve after-tax contributions the 401(k) this strategy, is desirable because it has less impact on taxable income.

For this to work, 401(k) Plans must include an after-tax deferral feature, a Roth 401(k) feature, and allow for In-Plan Roth conversions. Aside from potential 401(k) Plan Amendments needed and the ability of a recordkeeper to account for additional sources, there are many other important considerations which are the focus of this paper. A deeper dive on the “Mega Backdoor” conversion strategy is outlined below.

The 401(k) Plan Basics:

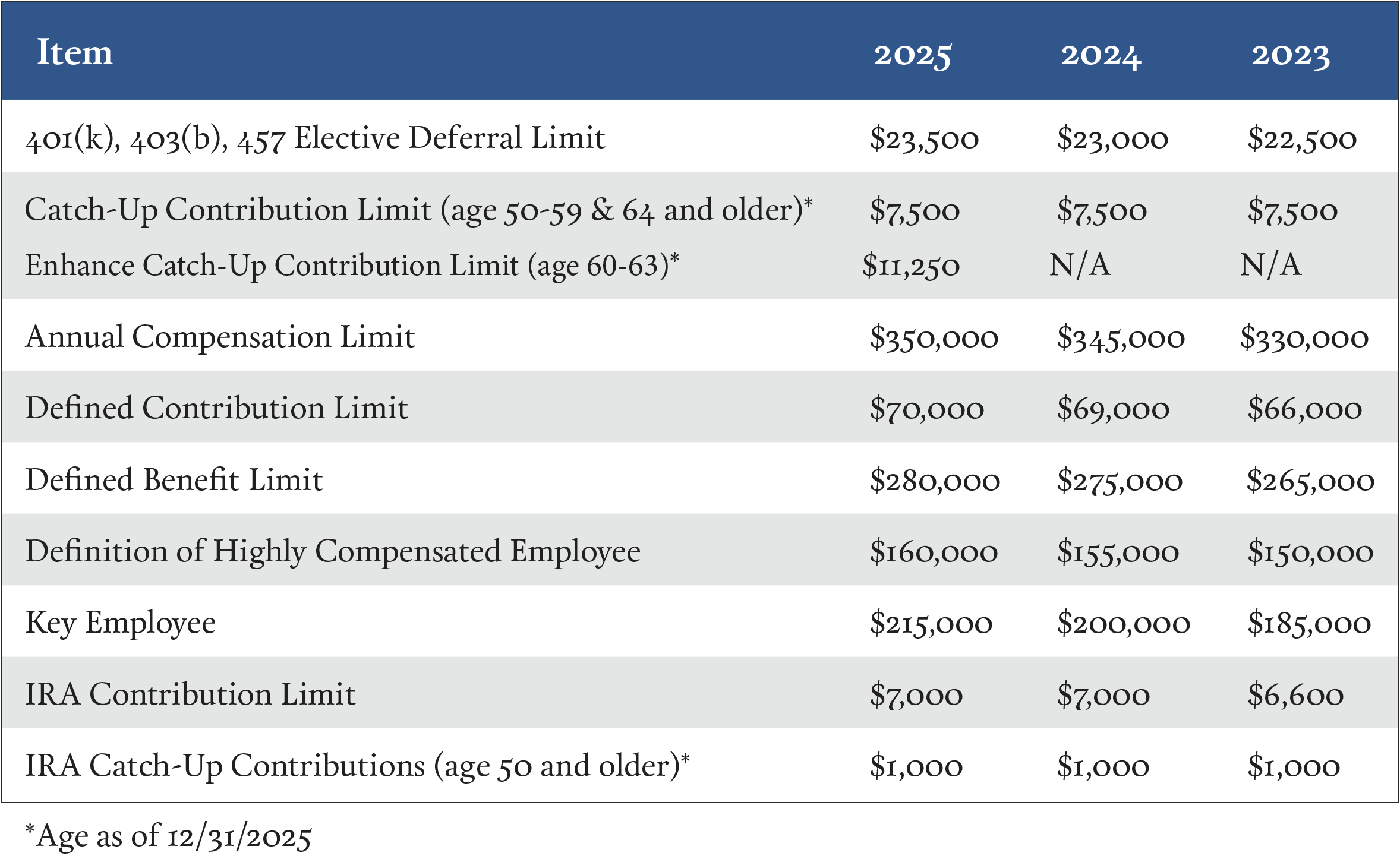

For the 2021 calendar year, IRS permits 401(k) Plan Participants to save up to $19,500 in their 401(k) Plan. Participants who attain age 50 or older anytime during the calendar year may defer an additional $6,500 referred to as “catch-up contributions” provided this is permitted in their 401(k) Plan. These savings are referred to as participant deferrals which may be directed into the plan either as traditional pre-tax deferrals, Roth after-tax deferrals, or in any combination.

The 2021 IRS annual 401(k) deferral limits are referred to simply as the IRC 402(g) limits. These limits are tied to an inflation index and updated annually as needed.

Technical Point– Unlike Roth IRA’s which are a specific type of individual retirement account often used in coordination with, or as an alternative to a 401(k) Plan, there are no MAGI income limitations associated with Roth 401(k) deferrals. All 401k Plan Participants regardless of their MAGI are permitted to contribute up to $19,500 or $26,000 as Roth 401(k) deferrals depending on their age.

In addition to the 2021 402(g) limits that pertain to Participant deferrals, another IRS limit called IRC 415 (a reference to the applicable code section) Annual Addition Limit applies to the total annual additions permitted each year. The IRC 415 Annual Addition Limit for 2021 is $58,000 not including the age 50 catch-up.

Why have two limits? The short answer is that Uncle Sam can’t afford for individuals and companies to shelter too much income when it comes to retirement savings as this reduces the tax revenue collected. Common employer contributions included in the 415 Annual Addition Limit are employer match contributions, employer safe harbor contributions, and employer non-elective (profit sharing) contributions.

A 401(k) Plan may also permit Participants to make voluntary after-tax deferrals. Voluntary after-tax deferrals are included in the 415 Annual Addition Limit but not in the 402(g) limit, creating an opportunity for savers to contribute more than $19,500 or $26,000 in 2021 for retirement. 401(k) Plan Participants may take advantage of this assuming income levels are sufficient to support higher savings.

Example 4: George participates in a 401(k) Plan. George is under age 50 and may contribute $19,500 in 2021 (pre-tax and/or Roth after-tax) and save another $38,500 “after-tax” assuming George’s company does not make any company contributions (match, profit sharing) to reach the 2021 415 Annual Addition Limit of $58,000.

It is recommended that all Participants defer the maximum pre-tax and/or Roth after-tax contributions before saving after-tax money because of the preferential tax treatment as well as other potential advantages (such as being eligible for any company match).

After-Tax History:

Well before the concept of “Roth” was introduced as part of the Taxpayer Relief Act of 1997, many 401(k) Plans permitted voluntary after-tax deferrals to facilitate additional retirement saving opportunities for Plan Participants. Back in 1997, the 402(g) limit was much lower ($9,500) and the age 50 catch-up contribution wasn’t introduced until several years later (2002). Faced with less retirement savings capacity, opportunities to save more even with voluntary after-tax deferrals were desirable.

Although many 401(k) Plans delivered these additional savings opportunities, voluntary after-tax savings never achieved the same level of popularity as traditional 401(k) deferrals in large part because saving after-tax dollars is simply less affordable especially for non-highly compensated employees. Unlike the Roth, which eventually replaced voluntary after-tax options in most plans, earnings attributable to voluntary after-tax contributions are taxed as ordinary income at distribution.

Perhaps the biggest detractor for 401(k) Plans offering voluntary after-tax deferral options is the annual discrimination testing requirement. The specific test is referred to as the 401(m) Actual Contribution Percentage test (“ACP Test), which applies to company match contributions and voluntary after-tax deferrals. As previously noted, typically very few non-highly compensated Participants can afford to max-out their 401(k) deferrals and save additional after-tax monies. As a result, it’s common for ACP tests to fail resulting in after-tax deferrals having to be refunded back to highly compensated employees.

You might be saying, “Wait….our 401(k) Plan is a safe harbor plan….the discrimination test’s do not apply to us, right?”. Unfortunately, the ACP test is not remedied by the safe harbor employer contributions that are used to satisfy the Actual Deferral Percentage Test (ADP Test). Voluntary after-tax deferral contributions are ALWAYS subject to ACP Testing.

In summary, once Plan Sponsors were permitted to add Roth 401(k) deferral options to their 401(k) Plan, it immediately provided a better option for Plan Participants and the number of plans offering voluntary after-tax deferrals dwindled. This brings us to the “Mega Backdoor” conversion strategy.

The “Mega Backdoor” strategy:

As mentioned previously, this conversion strategy works the same way as the “backdoor” Roth conversion but uses voluntary after-tax deferral contributions if permitted to a 401(k) Plan as the funding source.

A Participant in a 401(k) plan could maximize deferrals in 2021 by deferring up to $19,500 or $26,000 and save additional monies on a voluntary after-tax basis. Once the voluntary after-tax deferral has been made, it is eligible for conversion to Roth assuming the 401(k) Plan permits In-Plan Roth conversions.

The income tax implications of this strategy could be minimal because the funding source was already taxed. However, investment gains attributable to the voluntary after-tax source would be taxed as ordinary income at the time of conversion. Depending on how long the voluntary after-tax monies remained invested in the plan prior to conversion, the taxation on the investment income may or may not be meaningful.

Here’s an example to illustrate why this is such an attractive strategy for Participants who can afford to save more for retirement:

Example 5: In 2021, a 401(k) Plan Participant named Mary, who is under the age of 50 and with a MAGI of $200,000, does not qualify to fund her Roth IRA. Mary wants to save aggressively for retirement and is looking for additional opportunities. Mary defers $19,500 in her 401(k) using either pre-tax and/or Roth after-tax deferrals. In addition, Mary defers $20,000 into the plan as a voluntary after-tax contribution, and immediately converts this to Roth using the Mega Backdoor conversion strategy.

Mary has successfully contributed $39,500 into her 401(k) Plan, significantly exceeding her permitted 402(g) limit for 2021. The entire amount Mary converted from voluntary after-tax to Roth will compound over time income tax deferred, and assuming the distribution is “qualified”, it will be distributed income tax free.

Technical Note– For distributions from any Roth source to be “income tax-free”, the distribution must be “qualified”. A “qualified” distribution includes a two-part test: part one is called the 5-year rule and part two is the age at distribution. Assuming both parts are satisfied, monies distributed from Roth are income tax free.

Part One: The “five-year” rule is satisfied if the initial deposit into Roth remains invested in Roth (sometimes called a season-period) for a minimum of 5 consecutive calendar years. For example, if an initial contribution into Roth is made anytime in calendar year 2021, the earliest an income tax free (“qualified distribution”) may occur is after January 1, 2026. Regardless of the timing of the initial contribution in 2021, the investor will be credited with the entire calendar year as the starting year for the 5-year rule.

Part Two: Individual must be over age 59 ½ for the distribution to be qualified (tax free)

In-Plan Roth Conversion Tracking:

Every conversion from pre-tax or voluntary after-tax to a Roth 401(k) inside the 401(k) plan is required to have a separate five-year tracking period. 401(k) Plan Sponsors considering adding an In-Plan Roth Conversion feature should coordinate with their recordkeeper in advance to make sure all conversion amounts can be tracked separately.

Monies distributed from Roth 401(k) conversion sources that are not qualified distributions come with serious tax implications for Participants. All earnings attributable to a Roth 401(k) distribution that is not a qualified distribution will be taxable. If a participant requests a Roth distribution prior to age 59 ½, earnings are also subject to additional 10% excise tax penalties.

Example 6: In 2021, a 401(k) Plan Participant named George, who is 59 years old with MAGI of $200,000, does not qualify to fund his Roth IRA but wants to save aggressively for retirement. George defers $19,500 into his 401(k) using either pre-tax and/or Roth after-tax deferrals. In addition, George defers $20,000 into the plan as a voluntary after-tax contribution and immediately converts it to Roth using the Mega Backdoor conversion strategy. The beginning year for the 5-year rule on this original $20,000 Roth 401(k) conversion is 2021, the first calendar year these monies may be withdrawn as a qualified distribution (tax free) is 2026.

Over the next three consecutive years (2022, 2023 and 2024) George converts additional voluntary after-tax contributions to Roth. Assuming the George retires in 2026 when he attains age 65, only the first $20,000 Roth conversion that occurred in 2021 is a qualified distribution that satisfies the 5-year rule, thus eligible for tax free distribution treatment. The other Roth conversions (2022, 2023, and 2024) can’t be distributed until each satisfy their own 5-year period before they become eligible for tax free distribution treatment.

ACP Test Implications:

As previously mentioned, voluntary after-tax contributions are subject to ACP Testing. The ACP Test presents the biggest hurdle in terms of expected Mega Backdoor conversion strategy success because of the limitations placed on the voluntary after-tax deferral contributions made by highly compensated plan participants.

The ACP Test operates much the same as the ADP Test. The ADP Test determines how much “on average” highly compensated employees (HCE’s) may defer each year relative to non-highly compensated employees (NHCE’s). The ACP Test works the same way but applies to all voluntary after-tax employee deferral contributions and any employer match contributions.

Example 7: ACP Testing Complications- In 2021, a 401(k) plan is amended to allow Participants to make voluntary after-tax deferral contributions into the plan. There is no employer match. During the calendar year very few NHCE’s defer using this voluntary after-tax feature. This scenario is common as typically employees with income less than $130,000 (the IRS HCE threshold) cannot afford to save $19,500 or $26,000 plus additional voluntary after-tax monies. For an ACP Test to pass, the average voluntary after-tax deferral rate among HCE’s is only permitted to be slightly higher than the average for NHCE’s

Sample Outcome- Assume only 1 employee who is a NHCE under age 50 can afford to save more than $19,500 in the plan and several employees who are HCEs utilize the voluntary after-tax savings option. Because participation and average voluntary after-tax deferrals associated with the NHCEs is so low, the ACP Test fails, resulting in refunds of the voluntary after-tax deferrals made by HCE’s along with any investment gains. The voluntary after-tax saving amounts HCE’s contributed to the plan to facilitate a Mega Backdoor conversion strategy are not permitted to remain in the plan.

If the HCE Participant converts voluntary after-tax contributions to Roth and later learns that these monies must be refunded because the ACP Test fails, all monies must be distributed from the Roth 401(k) source.

One retirement plan administrator shared a scenario that occurred further illustrating potential problems associated with a failed ACP Test. A HCE made voluntary after-tax deferral contributions to their plan and converted these monies to Roth using the Mega Backdoor strategy. Prior to the end of the year, the HCE terminated employment and initiated a direct rollover into their ROTH IRA. At the end of the year the ACP Test failed meaning the rollover to the ROTH IRA was ineligible. Technically all monies associated with the voluntary after-tax deferral contribution were required to be disgorged from the ROTH IRA rollover account.

If a 401(k) Plan allows for voluntary after-tax deferral contributions, it is possible the plan also permits these monies to be eligible for “In-Service” withdrawals, allowing Participants to rollover voluntary after-tax deferrals to a Roth IRA. Same as the prior example, if there is a failed ACP Test, any voluntary after-tax deferral contributions rolled over to a Roth IRA would be ineligible and subject to disgorgement.

Plan Design Considerations:

Plan Sponsors interested in pursuing voluntary after-tax deferral contributions and a Mega Backdoor strategy could limit or completely restrict HCEs from utilizing the after-tax deferral feature to satisfy the ACP test. Other ACP discrimination testing strategies such as using the “top paid” group election could also be used to promote better testing outcomes, but this will not guarantee “passing” results.

Either way, restricting participation in this strategy may be a difficult message for Plan Sponsors to send to their highly paid employees as these generally include key employees, executives, managers, corporate officers, etc. Notably this is the target group of employees typically with “capacity” to save more using this strategy.

Lastly, administrative and communication considerations should be factored in when it comes to tracking HCE’s for “inclusion” or “exclusion” from one plan year to the next. This is important to ensure that HCE’s who are not eligible for the after-tax deferral provision don’t “slip-in”, and other employees who are eligible for the provision understand their benefits and obtain prudent education.

Summary:

Roth accounts may deliver significant benefits to individuals depending on their tax rates and financial planning goals. Roth conversions can be initiated by anyone regardless of their modified adjusted gross incomes, making various conversion strategies very attractive especially to highly compensated employees looking for more “tax efficient” retirement saving capacity.

The recent press surrounding Mega Backdoor strategies within 401(k) Plans has garnered a lot of attention as a winning solution. But given the restrictions noted in this paper, notably the ACP Test, it isn’t something that is easily achieved within a 401(k) Plan.

At Aegis Retirement Partners we specialize in designing and administering qualified retirement plans. If you are interested in learning more about the Mega Backdoor strategy and other design features that could be a good fit for your business and your Plan’s Participants, please give us a call.

Aegis Retirement Partners, LLC

86 Baker Avenue Extension, Suite 309

Concord, MA 01742

(781) 604-9007

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Aegis Retirement Partners and Cambridge are not affiliated. The information in this email is confidential and is intended solely for the addressee. If you are not the intended addressee and have received this email in error, please reply to the sender to inform them of this fact. We cannot accept trade orders through email. Important letters, email, or fax messages should be confirmed by calling (781) 604-9013. This email service may not be monitored every day, or after normal business hours. These are the opinions of Doug Norberg and not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized advice. Please be sure to speak to your financial professional to carefully consider the differences between your company retirement account and investment in an IRA. These factors include, but are not limited to changes to availability of funds, withdrawals, fund expenses, and fees. Please speak to your tax professional regarding your unique circumstances. Cambridge does not offer tax advice. These examples are hypothetical and for illustrative purposes only. The rates of return do not represent any actual investment and cannot be guaranteed. Any investment involves potential loss of principal.